TAX INFORMATION

UNDERSTANDING THE TAX RATE

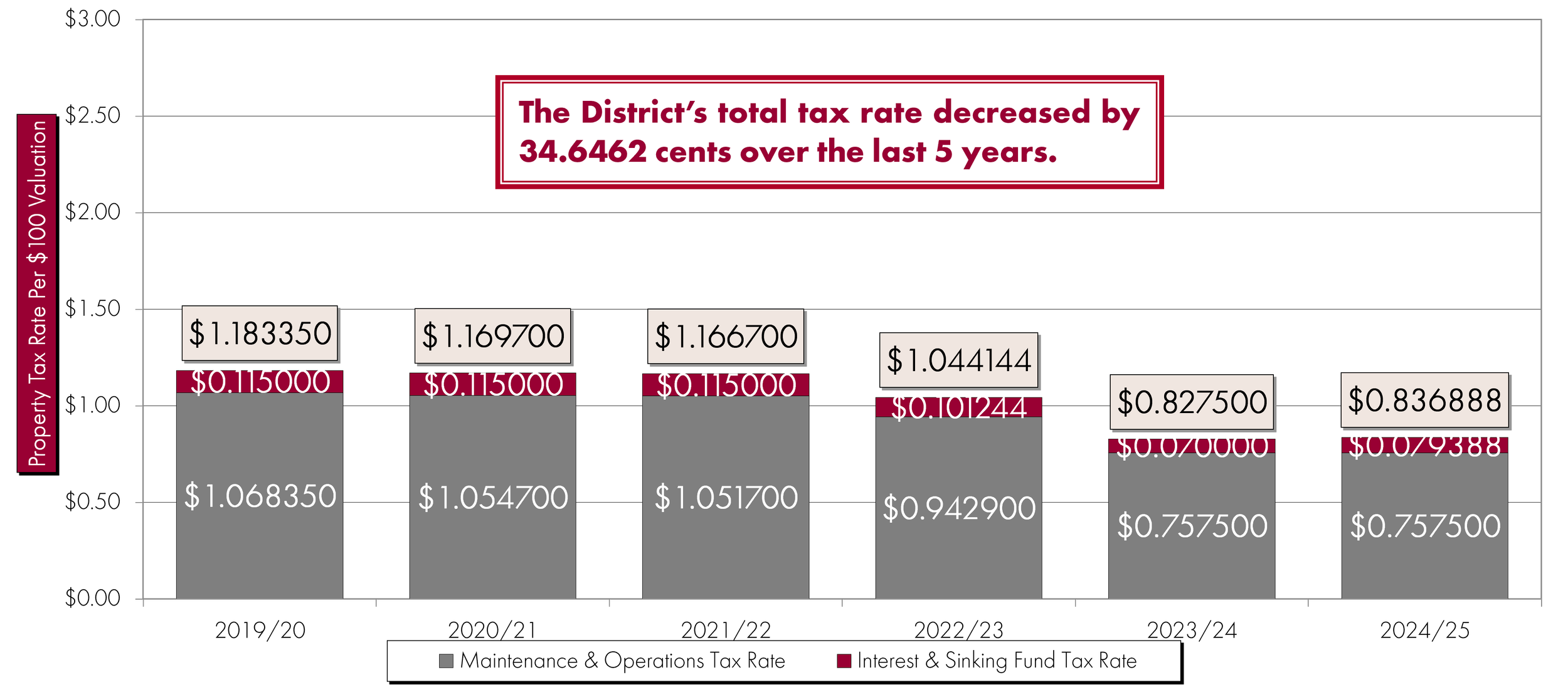

Each year, the district adopts two tax rates, which determine the total tax rate. These two rates divide the school district budget into two “buckets” - the maintenance and operations (M&O) rate and the interest and sinking (I&S) rate. Each has a designated purpose and budget.

M&O Tax Rate vs. I&S Tax Rate:

The M&O budget is used for daily operations of the district, including utilities, salaries, supplies, repairs, and fuel.

The I&S budget is used to repay debt for capital improvements through voter-approved bonds. These improvements include new construction, renovations, HVAC and roofing replacements, land purchase, furniture, and technology.

Bond elections only affect the I&S tax rate. Funds from a bond CANNOT be used as part of the M&O budget or to increase salaries.

TROUP ISD TAX RATE

HOW DOES THE BOND IMPACT MY TAXES?

The estimated maximum tax increase is anticipated to be 28 cents for a total tax rate of up to $1.12 per $100 assessed value. For a home value of $300,000 this represents an increase of approximately $38.31 per month, or $459.68 annually.

The following estimates the maximum projected annual and monthly tax impact of a $22,205,000 bond program on the appraised market value of a homestead only, including a $140,000* state mandated homestead exemption.

MONTHLY TAX IMPACT CALCULATOR

NO TAX INCREASE FOR HOMEOWNERS 65+

According to state law, the dollar amount of school taxes imposed on the residence homestead of a person 65 years of age or older or disabled, who has filed for such exemption, are frozen at the amount paid in the first year after the person qualified for the over 65 or disabled exemption and cannot be increased unless improvements are made to the home.